Welcome to the Matrix: Cryptocurrencies

Download this article as a PDF.

“Denial is the most predictable of all human responses.” — The Architect, The Matrix, 1999.

In The Matrix, one of the top cyberpunk movies of all time1, the protagonist, Neo, is offered the option of a red or blue pill by the rebel leader, Morpheus. The choice represents the acceptance or rejection of the illusions that constitute the status quo: the willingness to learn a potentially unsettling or life-changing truth – the red pill, or remain in contented ignorance – the blue pill. Neo takes the red pill, setting in motion the narrative that nothing will ever be the same.

With the world moving from analog to digital, the global economy is now experiencing the most significant changes in modern times, affecting the financial markets, the monetary system and global trade and commerce. This evolutionary process may be the fastest and shortest period of change we have ever experienced. In this extreme transition, attention to digital currencies has been significant. We suggest that the recent uptake in cryptocurrencies is a natural part of the transition and investors need to take notice. In this new acceleratory phase, will investors acknowledge the evolutionary process by taking the red pill?

Cryptocurrencies: Not the New Kid on the Block

Contrary to popular belief, cryptocurrencies have been in development for more than just a couple of decades. Bitcoin – the leader in the space – is an open-source monetary system, storing and transmitting an asset of value whose underlying code is fully open to the public. Transactions are verified and recorded in a public ledger called a blockchain through a process called mining.

For many, the story of bitcoin began in 2008 when a whitepaper was published by Satoshi Nakamoto, a presumed pseudonym to hide the identity of the person (or persons – perhaps a cyberpunk2 group?) responsible for the origins of bitcoin. However, bitcoin’s backstory started in World War II, when cryptography – a means of coding secret information – was used to win the war.

Bitcoin and other blockchain currencies rely on cryptography practices to maintain their fidelity. In the 1980s and 1990s, a group of cyberpunks would meet and communicate about the potential to use complex math to change the world for the better, including cryptography, economics, and censorship. They planted the roots of today’s populist movement, and their writings laid out the assumptions that would drive the basis for the cryptocurrency space.

In June, 1996, a team from the National Security Agency published a whitepaper titled, “How to Make a Mint: The Cryptography of Anonymous Electronic Cash,” acknowledging the future effects of the information age on the global economy. In 1998, Nick Szabo introduced the notion of scarcity when postulating a decentralized digital currency.

Szabo theorized that precious metals and collectibles had scarcity due to their high cost of creation and he attempted to create “Bit Gold” using online protocols to develop “bits” that would remain scarce and have minimal dependence on trusted third parties. To create scarcity, he developed a platform that would have participants use computer power to solve cryptographic puzzles, with each solution becoming part of the next challenge. While Bit Gold was never implemented, it is now considered the architecture that allowed for the birth of bitcoin. Scarcity remains a key element that has allowed bitcoin to act as a substitute of fiat currency.

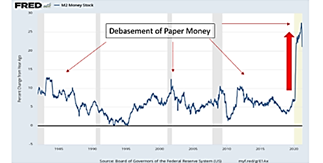

Today, we see a seemingly abrupt interest in cryptocurrencies. To be clear, the Covid-19 pandemic was the catalyst that brought this developing asset class into the mainstream. With the explosion of public debt created to combat the pandemic, many have feared the potential repercussions. History reminds us of the precursors to World War II – ravaging hyperinflation and the resultant Great Depression.

A large cohort of investors and academics believe that deficits are bad and the printing of money will lead to hyperinflation, which erodes the real value of a currency as the price of goods increases. Cryptocurrencies are seen as a hedge against the debasement of fiat currencies.

Millennials and younger generations have been attracted to cryptocurrencies for this very reason (after all, gold is for grandparents!) and also because of their decentralized nature. Many have been disillusioned by government policy and decision making, largely stemming from the support given to Wall Street during the Global Financial Crisis.

Current Crossroads: Reminiscent of Internet Adoption

In our 2021 market forecast, we suggested that digital assets were going mainstream and, contrary to the cries from the status quo, it looks as though they are.

We liken this to the gradual adoption of the internet witnessed at the start of the millennium – a natural evolutionary process. In the late 1950s, the U.S. developed a backup communication system that could be used in the event of a nuclear war with Russia – the foundation for what we now know today as the internet. Too many people forget the early days, when dial-up internet was slow and very few people had access to it. Yet, by 2005, and with the rise of the smartphone, a period of massive rapid adoption occurred. The adoption curve of digital assets could follow the same path.

The implications are that traditional finance companies and central banks can no longer ignore this natural evolutionary process. Western central banks and money centre banks are finally embracing the evolutionary process. Just as the internet disrupted the brick-and-mortar retail industry, so, too, will blockchain and cryptocurrencies disrupt the finance industry.

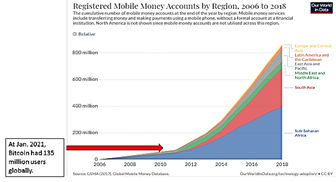

With 3.5 billion people in the world having a smartphone, one can easily see that the total addressable market (TAM) for individuals to own bitcoin and other digital assets is significant3. Customer acquisition costs for digital wallets are estimated to be close to $204; the cost to acquire a traditional retail banking customer has been estimated between $200 and $1,0005.

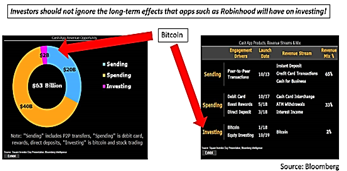

This is the classical disruption event first introduced by Clay Christensen6 in his book, The Innovator’s Dilemma. Disruptive innovators are made possible because they start in two types of markets: i) low-end footholds, where incumbents ignore low-margin segments; and ii) new-market footholds, where disruptors create a new market where none existed. The marriage of digital wallets and digital currencies provides a perfect hotbed for disruption. According to Bloomberg, only 2% of the assets that are located in digital wallets are used for investment purposes. Traditional financial institutions will be forced to innovate, and they will to some extent, as they have involuntarily taken the red pill.

The digitization of finance – and money – is just part of an evolutionary process started many decades ago, and the opportunities may be too big to ignore.

To the Naysayers: Fact Checking May be Required

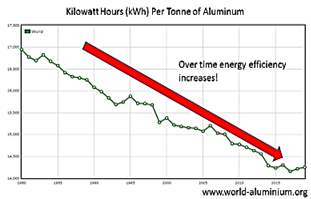

As with any disruption, there will, no doubt, be those who criticize. More recently, criticism over the environmental impact of mining bitcoin has been enough to push markets downwards after their spectacular rise. However, as with any infant industry, efficiencies will continue to increase as the industry matures. For instance, the use of energy in aluminum production has continued to decline over the decades.

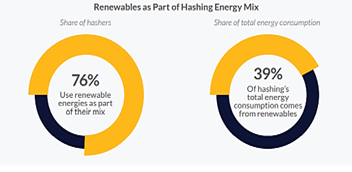

A Cambridge University report7 estimates that over 39% of the energy used by the digital currency industry is actually renewable, and 76% of the industry uses some form of renewable energy. With increased focus on ‘net zero’ goals globally, this is likely to drive continued adoption of environmentally-friendly solutions. History suggests it would be folly to assume otherwise.

More curiously, according to Michael Saylor8, head of MicroStrategy, a company that provides business intelligence, we manufacture too much energy. The world generates 160,000 terawatt-hours of energy each year; of that, 50,000 terawatt-hours are wasted, yet the effects on the environment are felt. Recall that energy cannot be stored; once it is created, it must be consumed. The bitcoin network uses 120 terawatt-hours per year, which equates to less than 25 basis points of the total wasted energy, or 7.5 basis points of all the energy produced. Saylor suggests that the bitcoin network is the bidder of last resort for overproduced energy. In this context, claims against cryptocurrencies harming the environment appear somewhat misplaced.

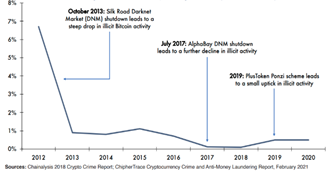

Older condemnations have suggested that cryptocurrencies would be banned because of the ease of transaction for sinister activities. Interestingly, as the uptake of cryptocurrencies has increased, the data to support these claims continues to diminish9. In fact, the amount of illicit activity associated with bitcoin has significantly declined since 2012. Ironically, in contrast to this decline, fraudulent activity involving plastic credit and debit cards has increased over recent years. This should remind us of the reality that bad characters will continue to operate across all areas of the financial system, regardless of the platform.

Continuing Adoption: Look Who is at the Helm

Adding to the momentum of mainstream acceptance is that many leaders who will drive global policymaking support the cryptocurrency space. The new SEC Chairman, Gary Gensler, while a former Goldman Sachs banker, was also a professor at the MIT Sloan School of Business who taught a course in blockchain and cryptocurrencies. In a December 2019 opinion article, he wrote: “The potential for this technology to be a catalyst for change is real…this new form of private money and its underlying shared-ledger technology already have been catalysts for central banks, big finance and big tech.”10

In late 2018, then IMF managing director, Christine Lagarde, in a speech on digital currencies echoed the view of Greek philosopher, Heraclitus of Ephesus, when she said: “change is the only constant.”11 In her speech, Madame Lagarde rightly pointed out that: “we are at a historic turning point…a new wind is blowing, that of digitization…and the key is this: money itself is changing.” The tailwinds are, indeed, blowing.

It is no wonder that many central banks, including Canada’s, are exploring the issuance of their own digital currencies. Central bank digital currencies, or CBDCs, are digital equivalents of banknotes and coins, giving holders a direct digital claim on the central bank and allowing them to make instant electronic payments. End‐to‐end digital ways of transacting have suddenly replaced long‐entrenched analog ways of doing things.

One area in which the regime has shifted is in the U.S. stablecoin market. Stablecoins are financial obligations issued on a blockchain. They are generally fully collateralized with either fiat currency deposits at a bank, or with short‐term government bonds held by a custodian. Stablecoins were invented to be a bridge between analog and digital worlds in the USD payments system. Yet, the real story is in its trading volume: annualized stablecoin volume is $16 trillion12 compared to the U.S. business-to-business payments volume of $25 trillion. More importantly, the velocity with which stablecoins are traded is around 109 times.13 Under the radar, it appears that the old analog payment system has taken the red pill and is past the point of no return.

In response, the U.S. Federal Reserve is working towards establishing a framework whereby new financial institutions focusing on digital assets can get direct access to the Federal Reserve payments system. This is a massive development. Simply put, bitcoin users may eventually be able to access the Federal Reserve payments system: bitcoin and USD will be settled in real time! Technology is driving rapid change in the payments landscape.

What Should Investors Do?

With the recent accelerated uptake, a high degree of skepticism from the status quo should be expected. But with any change, this is often the case: when the internet was introduced in the early 1990s, there was little expectation that it would become the backbone of the digital economy. Investors should accept the denial from the status quo: what we are experiencing is just part of the natural evolutionary process of the global economy.

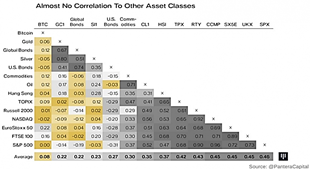

In this evolution, the basics of asset allocation also need to adapt. The old tried-and-true 60/40 asset allocation – 60% stocks and 40% bonds – is being replaced by 50/30/20, in which the 20% represents alternatives. Alternatives are assets that are uncorrelated to the day-to-day movement of the stock market and provide diversification to a portfolio.

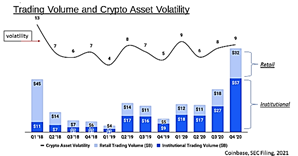

The father of the 50/30/20 portfolio was David Swensen, former CIO of the Yale University endowment, who decades ago started investing in uncorrelated assets. In 2018, he began investing in companies focused on blockchain and cryptocurrency. Harvard, Stanford, MIT and others – all long-term, reputable institutional investors – have since followed suit.14 In fact, institutional trading in this space is now greater than retail trading.

For some investors, cryptocurrencies are also seen as a hedge against the debasement of fiat currency. In an era of massive deficit expansion, they will continue to be viewed by many as an attractive hedge. One only has to look at what happened to the German mark in the 1920s to see why bitcoin is the go-to store of value for many in the internet age – hyperinflation drove gold’s staggering ascent prior to the Great Depression.

Of course, caution is warranted. As with any new asset class, or technology, investors must expect volatility to be very high. To be sure, there will be massive boom and bust cycles, but for those investors who approach this unique period with an open mind and prudence, the rewards could outweigh the risks.

We cannot ignore the fact that the global economy is evolving from analog to digital – a process that started decades ago. The digitization of commerce, global trade, money and trust will continue. Investors should heed the prophetic words of Neo: “I know you’re out there. I can feel you now…you’re afraid of change. I do not know the future. I did not come here to tell you how it was going to end. I came here to tell you how it was going to begin.”

This is a time in which investors have access to the red pill of an evolutionary process that has been decades in the making.

References:

[1] A sci-fi genre involving a lawless subculture of an oppressive society dominated by computer technology.

[2] Individuals advocating widespread use of cryptography as a route to social and political change.

[3] To be clear, our discussion is focused on bitcoin or Ethereum. We in no way advocate investing in altcoins such as Dogecoin.

[4] Why Invest in FinTech Innovation, ARKF, Mar. 31, 2021.

[5] https://medium.com/unifimoney/changing-the-vicious-cycle-of-push-to-pull-in-customer-acquisition-6218c8644000.

[6] The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail, C. Christensen, 1997, Harvard University.

[7] Third Global Cryptoasset Benchmark Study, Blandin, Pieters, Wu, Eisermann, Dek, Taylor, Njoki, Cambridge. University, September 2020.

[8] https://mybroadband.co.za/news/cryptocurrency/397055-bitcoin-electricity-usage-why-elon-musk-has-the-wrong-end-of-the-stick.html.

[9] An Analysis of Bitcoin’s Use in Illicit Finance, Morell, Kirshner, Schoenberger, April 2021.

[10] https://www.coindesk.com/even-if-a-thousand-projects-dont-make-it-blockchain-is-still-a-change-catalyst.

[11] Winds of Change: The Case for New Digital Currency, November 14, 2018, IMF, Singapore.

[12] Coinmarketcap.com.

[13] Ten Stablecoin Predictions and Their Monetary Policy Implications, Cato Institute. The velocity of money is a measurement of the rate at which money is exchanged in an economy. U.S. velocity is around 1.44X.

[14] https://www.coindesk.com/harvard-yale-brown-endowments-have-been-buying-bitcoin-for-at-least-a-year-sources.