Download this article as a PDF.

The Tax-Free Savings Account (TFSA) allows Canadians to save and invest funds tax free in order to fund a wide variety of short and long-term financial goals.

TFSAs were introduced in 2009 to provide Canadians with an additional tax-advantaged account to augment their savings for longer-term needs such as retirement, or for more immediate goals such as a vacation or vehicle. Any Canadian resident 18 years of age or older who possesses a valid social insurance number (SIN) can contribute to their TFSA, subject to their contribution limit (see below).

Key features of the account include:

• Contributions to a TFSA are not deductible for income tax purposes, unlike those made to a Registered Retirement Savings Plan (RRSP).

• Any investment income or gains earned on TFSA contributions are not subject to income taxation.

• Any withdrawals from a TFSA are not treated as taxable income, again unlike those made from an RRSP.

TFSA Contribution Room

• An individual’s TFSA contribution room is the maximum amount that can be contributed to their TFSA.

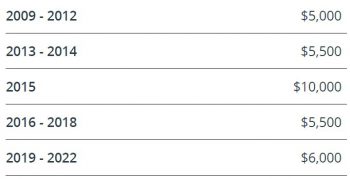

• The 2023 TFSA annual dollar limit is $6,500. The TFSA annual dollar limit is indexed to inflation and rounded to the nearest $500. Here is a summary of previous annual TFSA dollar limits:

For part years, say the year in which an individual turns 18, emigrates from or immigrates to Canada, they receive a full year entitlement. Thus, if an individual living in Canada was 18 years of age or older in 2009 and has not previously contributed to a TFSA, they can contribute up to $88,000 in 2023.

An individual’s TFSA contribution room is calculated as follows:

• The TFSA dollar limit for the year; plus

• Any unused TFSA contribution room from previous years; plus

• Any withdrawals made from a TFSA in a previous year; less

• Any contributions made during the current year

An example

Maria is 61 years of age. She contributed her TFSA annual dollar limit between 2009 to 2015. In 2016 she liquidated her TFSA of $55,000 to help her son purchase a condo. She recently received an inheritance of $120,000 and would like to contribute to her TFSA. How much can she contribute?

$6,500 (2023 TFSA annual dollar limit) + $40,500 (2016-2022 TFSA unused contribution room) + $55,000 (2016 withdrawal) = $102,000.

Maria can contribute a total of $102,000 to her TFSA and shield income and capital gains from taxation.

An individual can find their TFSA contribution room information on any of the following CRA services: My Account for Individuals, MyCRA – CRA’s mobile app, and the Tax Information Phone Service (TIPS) at

1-800-267-6999.

Death of TFSA holder

Several succession and tax planning questions arise when a TFSA holder passes away. The following questions should be considered and addressed by TFSA holders:

• Should a named beneficiary or successor holder designation be included either on the TFSA document or the TFSA holder’s will? If no beneficiary is named, the TFSA will be collapsed and payable to the TFSA holder’s estate.

• Does the TFSA need to be wound-up and paid out, or can it continue and be rolled over?

• How will income and gains be treated after the death of the TFSA holder until payout or rollover?The answer to this question will depend on the beneficiary or successor holder named.

While the collapse or transfer of the TFSA is not a taxable receipt to the deceased TFSA holder or recipient (named beneficiary or successor holder), the above points should be considered. TFSA holders should discuss their TFSA with their legal and wealth professionals to ensure their testamentary intentions are fulfilled.

Noteworthy tidbits

Here is a collection of other noteworthy TFSA points to consider:

• Spouses or common-law partners (CLPs) can gift TFSA contributions to their recipient spouse/CLP without being subject to income attribution rules.

• Income or gains earned within a TFSA and withdrawals from a TFSA are not reported for tax purposes, and thus will not impact federal income-tested benefits and credits such as Old Age Security (OAS). This is especially useful for Canadian retirees, making the TFSA a fantastic cash flow tool to support retirement lifestyle expenses.

• No tax relief is provided where foreign tax is withheld on foreign income reported within a TFSA. TFSA holders should consider the nature of investments held in their TFSA.

• Investment losses incurred in a TFSA are not considered a withdrawal and will not provide any form of tax relief.

• Contributions of foreign currency or in-kind securities must be converted to Canadian dollars at fair market value for purposes of contribution tracking.

• Administrative or other fees in relation

to a TFSA and any interest on money borrowed to contribute to a TFSA are not tax-deductible, as they were not incurred to generate taxable income.

• U.S. persons should reach out to their cross-border tax advisors to determine if they should open a TFSA in light of the U.S. information and income reporting requirements.

The information presented in this article is not intended to be exhaustive. For further information on the TFSA, please refer to:

Reach out to your Wellington-Altus Advisor to discuss how to best utilize this savings vehicle.