There are many reasons why preparing income tax returns for a deceased individual in the year of death can be complicated. However, we would be remiss to not recognize the planning opportunities available in appropriate client situations. While normally individual taxpayers may only file a single return for a given tax year, in the year of death, there is the option to file multiple tax returns.

The information below describes some of the benefits associated with filing multiple terminal tax returns in the year of death, both from an income tax and beneficiary perspective.

What are the benefits of filing multiple returns?

Canadian individuals are subject to marginal income tax rates. This means that the more income and gains reported in a given year, the higher the effective income tax rate will be. Therefore, if the same income and gains are split out and reported on separate terminal tax returns, tax savings are generated and beneficiaries are better off. Notably:

Each additional terminal tax return provides a separate set of marginal tax brackets for the deceased taxpayer. While the deceased taxpayer will have the same amount of income in the year of death, spreading that income over multiple returns will lower their effective tax rate.

Filing multiple terminal tax returns also multiplies access to a limited amount of income tax credits. For example, each of the terminal tax returns can claim the “Basic Personal Amount” tax credit, which would further reduce the effective tax rate when compared to filing a single return. It’s also possible to split certain credits between returns to optimize their use.

Elections to file separate returns

In the year of death, the Income Tax Act provides that under certain circumstances, the executor may file additional income tax returns on behalf of the deceased, depending upon the nature of income and gains received. Up to four tax returns may be filed in relation to the year of death:

Mandatory Return:

- T1 income tax and benefit return

Elective/Optional Return(s):

- Rights or things return

- Business/partnership income return

- Income received from a Graduated Rate Estate return

Each of these returns and their requirements are discussed in more detail below.

01

T1 income tax and benefit return

This is the standard income tax return that is mandatory to file for every deceased taxpayer in the year of death. It is commonly referred to as a “Date of Death” Return (“DOD”) or a “Terminal” Return.

This return reports all income and gains reported from January 1st up to and including the date of death, except for amounts that are included in the elective returns described below. This tax return also includes any capital gains triggered due to the disposition of property deemed to occur immediately prior to the taxpayer’s death.

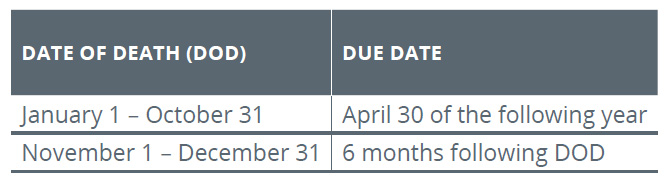

Due Date: This depends on the taxpayer’s date of death. Assuming that neither the client nor their spouse/common-law partner was self-employed, the due dates would be as follows:

02

Rights or things return

Amounts of income that are considered “rights or things” are eligible to be reported on a separate return. Simply put, a “right or thing” refers to amounts of income that have been earned and are receivable at the time of death but have not yet been paid or collected. Some common examples of “rights or things” can include:

- Unpaid commissions

- Unpaid EI, CPP and OAS benefits

- Amounts for unused vacation or sick time

- Salary and wages in certain circumstances

- Declared, but unpaid dividends

Due Date: To file a Rights or Things Return, an election must be filed with the Canada Revenue Agency by the later of one year after the taxpayer’s date of death, or 90 days from the date on the notice of assessment of the terminal return.

03

Business/partnership income return

Where the taxpayer is a proprietor or a partner of an unincorporated business that does not report income on a calendar year basis, a portion of the business income may be eligible to be reported on a separate return. Consider the following example:

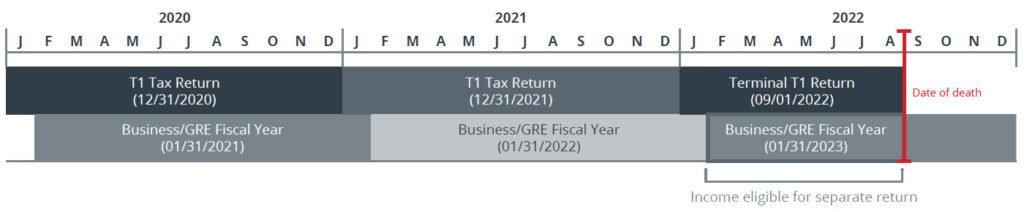

- Taxpayer dies on September 1, 2022;

- The taxpayer was a proprietor of a business at the time of their death; and

- The business has a fiscal year that ends on January 31.

As can be seen in the timeline on the following page, if the taxpayer were to have received income during the period of February 1 – September 1, 2022, that income would be eligible to be reported on a separate return.

Due Date: This elective return is due on the same date as the DOD return.

04

Graduated rate estate income return

An additional opportunity to file an elective return may be available if the deceased was a beneficiary of a Graduated Rate Estate (“GRE”) trust that does not report its income on a calendar year basis.

In the instance the deceased received income or capital gains distributed from a GRE, a separate income tax return is available to report as shown in the timeline below.

Due Date: This elective return is due on the same date as the DOD return.

Collaborate with your tax advisors

In the instance a taxpayer has died, it’s important to proactively reach out to the estate’s tax advisors to collaborate on the most effective tax reporting approach for income and capital gains for the year of death. Filing multiple returns can often be very beneficial for the deceased’s estate and beneficiaries, but when considered alongside the added complexity for the executor, additional professional fees and potentially longer timeframe to administer the estate, may result in little to no value. For more information and guidance, contact the Wellington-Altus Advanced Wealth Planning Group.