Breaking Bad: Modern Monetary Theory (MMT) Going Mainstream

“Now say my name…Heisenberg.” – Walter White, Breaking Bad (Season 5, Episode 7).

According to the Urban Dictionary, to “break bad” is to reject social norms for one’s own gain, regardless of the legality or ethics. Breaking Bad[1] – the Netflix series – follows the evolution of Mr. Walter White, a brilliant but overqualified high school chemistry teacher confronted with terminal lung cancer, a teenage son with cerebral palsy and his wife’s unexpected pregnancy. Walter begins cooking meth to provide for his family, soon becoming a ruthless, murderous drug kingpin. He justifies his new venture as the simple case of a business meeting the needs of the markets. Walter symbolizes the danger of rising populism, which, when left unchecked, can result in the deterioration of liberal democracies.

Walter’s street name, Heisenberg, is a tribute to the Nobel-winning physicist Werner Heisenberg, known for his principle of uncertainty.[2] While this principle was developed in quantum physics, it is often regarded for its philosophical juxtaposition: there are limits to what we can know; yet we cannot know the future with certainty. To wit, our society has simply ignored many long-term problems, the rationalization often being that we do not know with certainty that they will transpire.

Yet, the Covid-19 pandemic has changed everything. We now stand at a crossroads. We suggest that the health crisis has forced the need for a period of extreme structural change, as the significant rise in populism can no longer be left unchecked by policymakers. This will be enabled by the climate change agenda, which had largely gained acceptance globally prior to the pandemic. These circumstances will justify the acceptance of new economic philosophies, by policymakers and business leaders, including the controversial Modern Monetary Theory (MMT) – an ideology which simply states that deficits no longer matter.

Modern Monetary Theory (MMT): The Basics

First, a quick primer on MMT. MMT is focused on replacing the traditional concept that a federal government budget is constrained by how that government will pay for it, based on incoming revenues that are largely funded through taxation. Proponents of MMT suggest that this way of thinking is essentially flawed and, instead, policymakers should focus on mission-based budgeting.

The basic assumption of MMT is that the economy runs on sales and when demand is greater than supply for physical goods, inflation occurs. Inflation does not arise from money creation alone. MMT is about replacing the concept of a government budget constraint with an inflation constraint. Deficits can expand until the economy overheats and inflation is created. However, this can eventually be addressed by increasing taxes to reduce spending capacity and bring down inflation. MMT suggests that the budget created in Washington, D.C. implicitly assumes that we are still on the gold standard. The key point: if you can issue your own currency, you have no budget constraints. Local, provincial or state governments need tax revenue to carry out programs, but the federal government does not.

President Biden: Wading into MMT Waters

Today, the global economy faces a turning point similar to the one Franklin D. Roosevelt (FDR) and the world faced at the end of WWII. As FDR suggested to Congress in early 1945, “the point in history at which we stand is full of promise and of danger.”[3] President Joe Biden seems to understand that his presidency will be judged, in large part, on the degree to which his policies deliver material improvements in peoples’ lives.

Notably, Joe Biden is aware of the mistakes made during the 2008 global financial crisis. The recovery package that bailed out Wall Street left Main Street to field the

main brunt of the austerity. The decline in the standard of living of those who were not rich lit the proverbial match that gave rise to today’s burning populism. The polarization of views in Washington point to the fact that there does not exist a bipartisan solution to the problems of income inequality and climate change.

Maybe it took the Covid-19 pandemic to kill the deficit myth. As Joe Biden frequently states, “don’t tell me what you value, show me your budget, and I’ll tell you what you value.” What does Biden’s America value? From the onset, Biden’s agenda has been focused on tackling climate change, and in this fight, he realizes that deficits must expand.

MMT’s Enabler: The Transition to a Net-Zero World

Joe Biden’s $2 trillion green infrastructure bill should be labeled the electrification of U.S. transportation, and it will be the largest public investment in procurement, infrastructure and R&D since WWII. The Manhattan Institute[4] estimates the overall global push for electric vehicles (EVs) will increase demand for green energy commodities by up to 8,000%, which will be very supportive for silver, copper, nickel, lithium, iron ore and rare earth prices.

However, Biden’s current plan is not large enough to get to the “net-zero” goal. To meet the emissions targets outlined in the Paris Agreement, it is estimated that the U.S. will need to spend $1 trillion annually, or between three to five percent of GDP, for the next decade.[5] To replace the electric grid alone, which accounts for about one-third of America’s energy use, it would cost at least $5 trillion.[6] If we are serious about truly achieving “net zero,” trillions more will need to be spent.

Prior to the pandemic, many global leaders were aligned on the fact that the existential threat facing the world was climate change. The pivot by the central bank community on climate change can be pinpointed to a speech made by former Bank of England governor, Mark Carney, in a gathering of the financial elite at Lloyd’s of London. Mr. Carney rightly brought into question the blind faith that many have in the efficiency of the markets to take care of pressing social problems, referring to it as the “tragedy of the horizon.”[7] In promoting his new book, Value(s), during a call with the Dallas Federal Reserve, he suggested that Adam Smith’s The Wealth of Nations, often referred to as the foundation for neo-classical economics, should not be read in isolation. He asserts that the moral philosopher may have been taken out of context – in essence, markets do not always give society the best result. In the fight against climate change, Carney suggests that the markets cannot do it alone – markets can put monetary value on Amazon the Company, but not on Amazon the Rain Forest – they need help.[8]

MMT: Quietly Being Embraced by Leaders

As Jamie Dimon, CEO of JP Morgan, recently wrote in his annual shareholder letter: “when the government talks about spending money, it should not lead with the amount spent or budgeted to be spent – as if that’s the measure of success. Instead, the expected outcome of the spending and then the actual outcome should be described.”[9] The expected outcome is an inclusive green economy, and Dimon’s statement sounds surreptitiously like that of an MMT proponent.

Even central bankers appear to be quietly embracing MMT. Carney now points to economist Adam Smith’s earlier work entitled The Theory on Moral Sentiments, which suggests that markets don’t have values, people do. Carney posits that Smith’s point of view was that once we have determined what we want our world to look like, we can stand back and let the markets allocate

resources. While investors should not expect central bankers to explicitly state that deficits do not matter, they can expect that if inflation is well behaved, the expansion of deficits at this time will be tolerated as they were in the 1945-1951 period.

MMT: A Course for Hyperinflation & Devaluation?

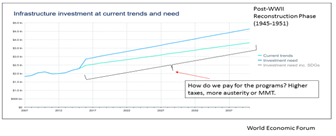

With the significant increase in deficits, critics of MMT suggest that we are at risk of hyperinflation and currency devaluation. Hence, the renewed interest and significant momentum in the cryptocurrency markets as of late. However, we suggest that these outcomes are less likely and we look to the post-WWII recovery period as a potential scenario. When comparing the Federal Reserve balance sheet expansion after WWII with today, it reveals that the expansion during the Depression and World War II era was far greater than the expansion during the global financial crisis and the Covid-19 pandemic. In addition, the amount of public investment as a percentage of GDP substantially increased and generated a strong tailwind for a rising standard of living and reduction in income inequality observed in the 1950s.

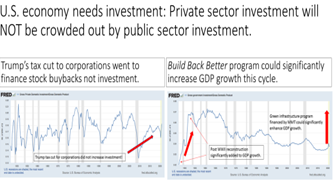

To be clear, the level of investment as a percentage of GDP in the U.S. economy is significantly below levels needed to generate robust economic growth. Investors should expect the level of public investment as a percentage of GDP to significantly increase. Biden is aware of this predicament: some of the needed spending will be financed by increasing the deficit, some by taxes and perhaps a portion by green bonds – sort of an MMT-lite approach.

As such, a period of strong cyclical growth should be expected and value stocks will come back in vogue. A global, post-WWII-esque, $15 trillion reconstruction boom financed by deficits is our base case.

This will not be a traditional business cycle. The pivot by central bankers and policymakers to focus on long-term social problems, supplemented by pent-up demand from pent-up consumers during the Covid-19 crisis, will cause explosive cyclical growth in the near term – similar to that experienced in the roaring 1920s – and in the intermediate term, a post-WWII reconstruction phase called Build Back Better.

What Should Investors Do?

We have entered a transformational period, which we believe will look similar to the post-WWII reconstruction period. MMT has the potential to play a critical role in our transition to an inclusive green global economy. Expect a period of significant deficit expansion – even if it’s not explicitly referred to as MMT. We are in the early innings of a major global asset allocation shift. Sectors and stocks that have been losers for the past 10 years may very well be the new winners.

During this period, we suggest that value, cyclicals, commodities and financials should accompany quality growth stocks in a well-diversified portfolio. This is not to say the digital era is dead, it’s not; however, it will no longer be the only game in town. Economic growth above potential will be the result, and inflation will be well behaved allowing the central bankers to keep interest rates lower for longer.

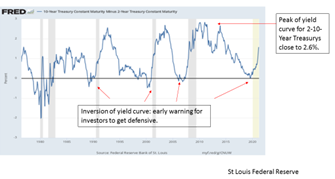

Investors should keep an eye on interest rates, more specifically the spread between the two-year and 10-year treasury bonds for clues. A typical cycle peaks at a spread close to 2.6%, and we suggest that this will similarly occur in this cycle. Long-term interest rates can rise further in this cycle, as can inflation, but neither are likely to get out of control. The key? That politicians follow through on their climate change commitments, and that the financing of these projects be done in a way that keeps the central bankers and the capital markets onside, while significantly increasing deficits.

We should also ignore the noise. As investors, we need to focus on opportunities and not on the intellectual jousting between adversaries. Expect significant pushback from the status quo, who will suggest that throughout history speculative bubbles have been debt fueled and have always ended with a brutal financial crisis. While this may be true, we suggest that this is what is called “a cycle.” Our view is that a significant increase in the deficit will be required to defeat climate change. Deficits do not matter – until they do, and they will; but just not at this current time. Today, with few options remaining, it appears that MMT will be the new tool used in this cycle to support massive deficit expansion.

Policymakers should also be wise enough to acknowledge that the rise in populism will not slowly fade away. Left unchecked, populism has been shown to eventually evolve into revolution, civil war or world war. This, alongside the climate change imperative, will support the use of MMT.

As the saying goes, do not fight the Fed – for as Walter stated in Breaking Bad: “It’s the constant. It’s the cycle. It’s solution, dissolution, just over and over and over. It is growth, then decay, then transformation. It is fascinating, really.”

As we enter this new transformational era, portfolios should be positioned to best take advantage. Walter was right: it’s just the cycle.

References:

[1] Breaking Bad Netflix Series 2008-2012, created by Vince Gilligan.

[2] https://www.britannica.com/science/uncertainty-principle.

[3] Franklin D. Roosevelt, message to Congress on the Bretton Woods Agreement, February 12, 1945.

[4] https://www.manhattan-institute.org/ideas-new-administration-energy.

[5] “Biden is Too Worried About the Deficit, Not Worried Enough About Climate Change,” Kate Aronoff, March 2021.

[6] Mark Mills, The Manhattan Institute https://www.city-journal.org/biden-agenda-on-energy-and-the-environment.

[7] The problem with the short-sighted nature of business decisions when dealing with pressing global problems.

[8] https://www.dallasfed.org/research/economics/2020/1201.

[9] https://reports.jpmorganchase.com/investor-relations/2020/ar-ceo-letters.htm.